¢lean $imple Tax

We help you get your maximum refund with minimum hassle, so you can relax and enjoy more of your money.

We help stop taxes from taxing you!

Tax Season Made $imple

- Individual Form 1040 with applicable schedules 1,2,3

- Supporting forms and schedules

- State and Local tax forms

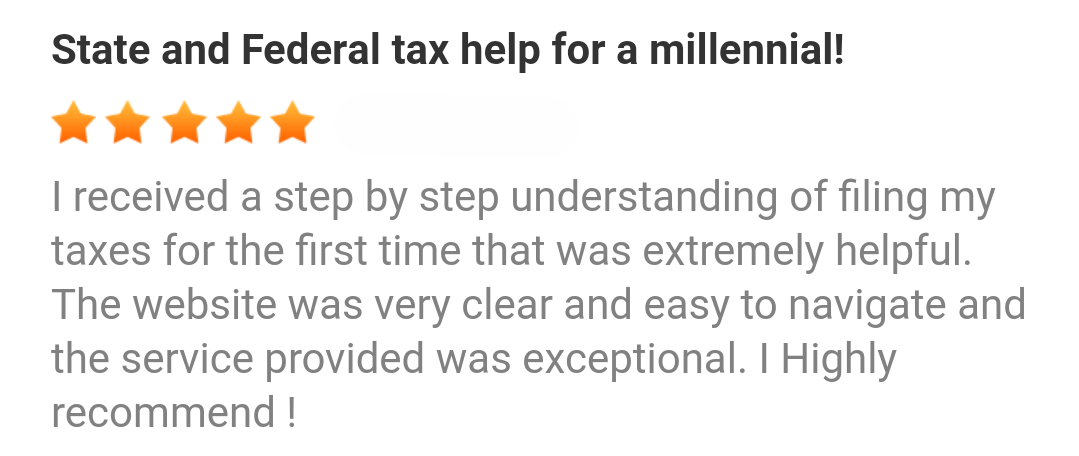

What Our Clients Say

1040 Tax Prep Subscription

Professional tax preparation made convenient and affordable!

- Subscription period runs annually from April 1 through March 31.

- Your filing requirements at the time of filing will determine your actual tax preparation cost.

- Subscription does not include taxes, penalties, or interest owed by the taxpayer(s).

- Unpaid subscription balances will be due at the time of tax filing, along with any additional tax preparation costs incurred.

- Subscription surpluses will be credited to your account, and your subscription will be prorated for the next subscription period.

Basic

$10.95 / month

- Federal Tax Return

- 1 State Tax Return

- Unlimited Email Support

- Money Skills Toolkit: Financial Management Resource Portal (Toolkitten-free)

Standard

$17.95 / month

- Federal Tax Return

- 1 State Tax Return

- Unlimited Email Support

- Chat Support January - April

- Money Skills Toolkit: Financial Management Resource Portal (Toolkitten-free)

- Tax Records Archive

Deluxe

$34.95 / month

- Federal Tax Return

- 1 State Tax Return

- 1 City/Local Tax Return or 2nd State Tax Return

- Unlimited Email Support

- Chat Support January - October

- Money Skills Toolkit: Financial Management Resource Portal (Toolkitten-free)

- Tax Records Archive

Promo Code TY25SP1040

¢$Tax Terms of Service

Identification Required

For verification and/or electronic filing purposes, you must provide the following identification documents:

- A valid (unexpired) government-issued photo ID and social security card for yourself.

- A valid (unexpired) government-issued photo ID and social security card for your spouse if you are married and filing a joint tax return.

- A valid social security card for each dependent you claim on your tax return.

If you are a returning client and your photo ID expired since your previous service, then you must submit your new valid photo ID prior to tax preparation.

Data Collection from Taxpayer

A Taxpayer Profile Questionnaire is required by our office each year so we can prepare your tax returns accurately while remaining compliant with tax laws and regulations. For your convenience, we offer online completion from your computer or mobile device. You should be sure to fill in all applicable information that you will need to provide for your ¢lean $imple Tax preparation.

----------

Electronic Document Submission

You can choose one or more methods that we provide for electronic submission of your required ID documents and tax forms. These methods are listed below and explained in detail within the Taxpayer Profile Questionnaire.

- Upload to our Client Portal – Create a secure full-service taxpayer account with username and password.

- Upload to our Dropbox – Get a secure shared folder in our Dropbox portal.

- Email to our Dropbox – Attach your documents to a pre-addressed email that goes directly to our secure Dropbox portal.

- Email to our ¢$Tax Mailbox – Send a regular email with your documents and forms attached.

- Text to our SMS Inbox – Send your documents as images via text message.

----------

You can view our Privacy Policy to learn more about how we process the information you provide.

Tax Preparation Fee

Your invoice for ¢lean $imple Tax preparation will be attached to the notification email that you will receive when your tax return is prepared and ready for E-filing. Your payment is due at the time you receive your invoice. We accept cash and checks (for in-person appointments only), online payments via our payment center, and payments via bank products provided by our office (some products subject to approval).

Click below to see our ¢lean $imple pricing for your ¢lean $imple Tax preparation.

Consultation Fee

A consultation fee will be charged for providing data entry and related consultation services if you decide not to file your tax return(s) with our office. The fee must be paid at the time your source documents are returned to you. We accept cash and checks (for in-person appointments only), and online payments via our payment center.

Preparing for Your Appointment

Our Source Document Guide will help you gather documents and other information that will help us get you the largest refund legally allowed.

Discounts for Tax Clients

Book Now Discount

You schedule your tax preparation appointment online via our website. You get $10.00 off your tax preparation fees.

Returning Client Discount

You were our client the previous tax year. You get $15.00 off your current season tax preparation fees.

Young Adult Discount

You are age 18-21 and your filing status is single. You get 18% - 21% off your first-time tax preparation fees.*

*Only first-time clients within specified age range are eligible. Discount percentage corresponds with your age at the time of your tax preparation services.

Toolkit Subscriber Discount

You have a paid subscription for the Money Skills Toolkit. You get $10 - $50 off your tax preparation fees.*

*Discount is equal to your Toolkit subscription fee for one month.