FinCEN NOTICE

March 26, 2025

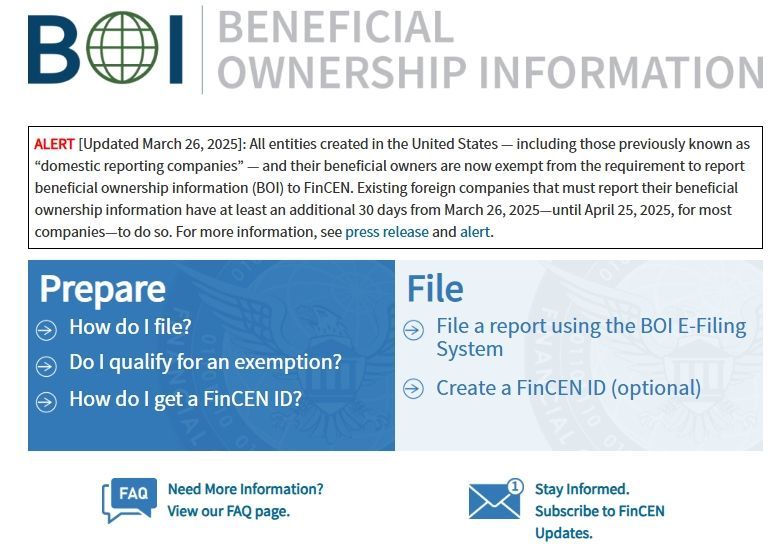

BOI Reporting mandate is revoked

for all entities created in the United States

See official notice and our BOI FAQ below. Get the latest updates at FinCEN.gov

FinCEN BOI Reporting

Business Reporting Mandate Effective January 1, 2024

As a result of the enactment of the Corporate Transparency Act (CTA), many businesses will be required to file a Beneficial Ownership Information Report (BOIR). Basic questions about this mandate are answered below.

(Not required for United States domestic entities as of March 26, 2025)

Legal Disclaimer

Where applicable, the management/owner is responsible for your company’s compliance with the Corporate Transparency Act (CTA), and for ensuring that any required reporting of Beneficial Ownership Information (BOI) is prepared and timely filed with the Financial Crimes Enforcement Network (FinCEN). IDL Financial Systems LLC can act as an agent for filing the report; however, we do not render any legal services as part of our engagement. Beyond this notice, we will not be responsible for advising you regarding the legal or regulatory aspects of your company’s compliance with the CTA. If you have any questions regarding your company’s compliance with the CTA, including but not limited to whether an exemption may apply to your organization or to ascertain whether relationships constitute beneficial ownership under CTA rules, we strongly encourage you to consult with qualified legal counsel experienced in this matter.

Need Us to File Your BOIR? Click to Pay $175

Click the button below to pay $175 at our payment center. After payment is confirmed, we will contact you to collect the information required for filing your BOIR.